Benefits of Buying from Goldline

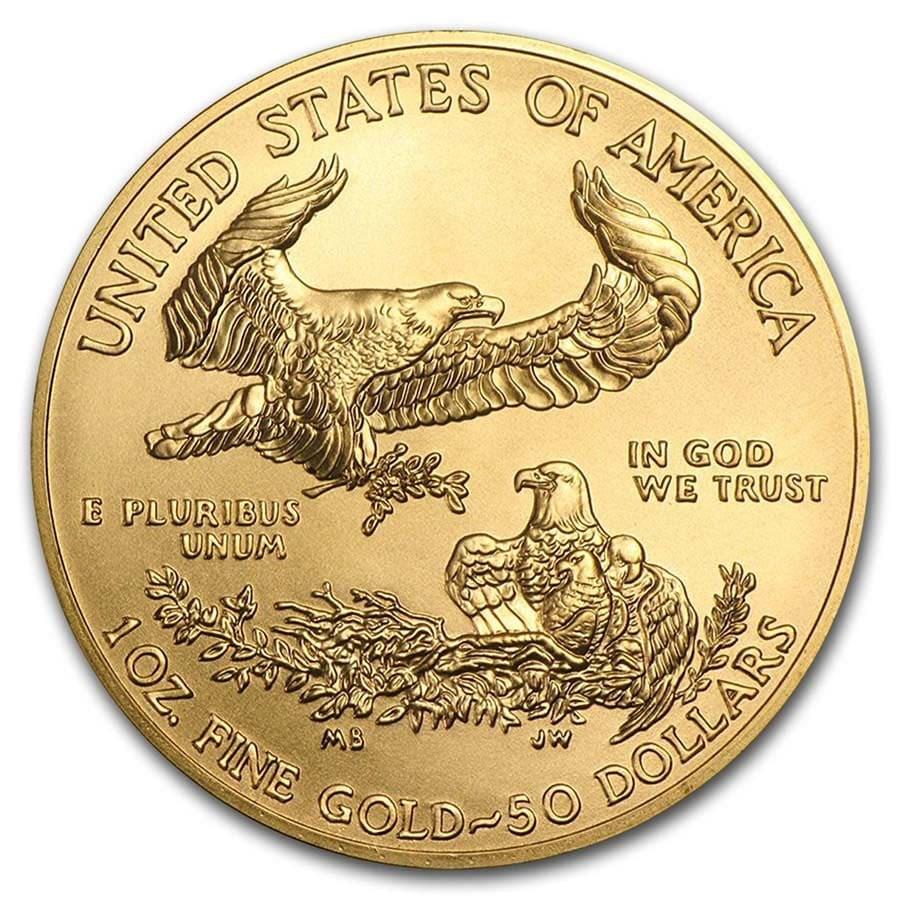

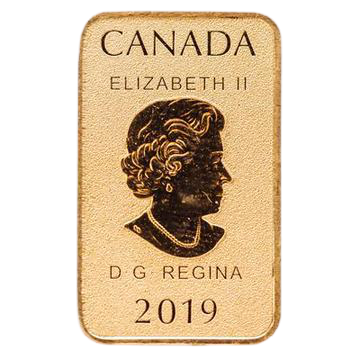

Some of Our Popular Products

—In times of economic turbulence and currency fluctuations, one asset has held its value and stood as a beacon of financial stability for centuries. This asset is GOLD, the universally admired symbol of wealth and prosperity. The demand for gold has been growing exponentially since the 1970s, spanning across economies, cultures, and markets around the globe. Its usage is broad, from jewelry and investments to industrial applications and central banks’ reserves, demonstrating its integral role in our financial world.